How to be a Long Term Profitable Trader – Risk Management, Risk:Reward Profile and Automations

Hey Matthew here from ProfitFarmers, your crypto copy-trading co-pilot, where we make profitable trading less time-consuming, less stressful, and more rewarding. Our platform combines copy-trade technology with algorithmic trading signals and pro-trade features to help you plan and execute high probability trades.

(This helpdesk article is also published on our blog here: https://www.profitfarmers.com/blog/how-to-be-a-long-term-profitable-trader/)

Let’s talk about how to be a long-term, profitable trader and how much money it’s really possible to earn from trading.

But before that, screw the Lambos, screw the watches, let’s get real for a while and think about:

- Sustainability

- Lifestyle

- and Health

Today, I’m going to walk through how you can achieve these things using nothing but your brain, some free calculators, and of course your trading skills. Trade automation are going to help MASSIVELY, but you can get some of the ways there without them.

Watch this video to learn all about it.

Want to see the written version? Just read below!

Let’s start with some basics

1. Risk Management

The golden rule! – Only risk 2-5% of your account size.

Let’s assume you’re trading with a $10,000 account

For example:

- You can risk 2% when you are less certain, markets could be choppy or you are getting mixed indications from different time frames.

- Or risk 5% when you are doubling down on a strategy you know is GOLD, or the market is in a strong trend.

For this guide, let’s go with 5% just so we have some simple numbers.

So, what does it mean to risk that 5%?

Noobs and beginner traders typically misunderstand this.

They think it means you should only make a trade size of 5% of your $10,000 account, or $500 per trade.

But that’s not how it works…

Actually what it means is that on a stop-loss hit you will lose a max of 5% of your entire account.

Let’s take a quick example.

$10,000 account

Your max risk per trade is $500 (5% of the total)

Entry – $1000

Stop-loss – $980

Risk = $20 / $1000 = 0.02 (2%)

$500 / 2% = $25,000 <= That’s how much you could place on this trade example without exceeding your risk profile.

We’ve got a spreadsheet you can use to figure this out quickly, feel free to download it from our risk management blog.

2. Risk to Reward

Alright, here’s another key to being profitable.

If Risk Management teaches you how to lose with grace, then Risk to Reward teaches you how to trade and profit with ruthless efficiency.

Risk: Reward is simple to understand – it’s a measure of how much you will win on trade vs how much you might lose.

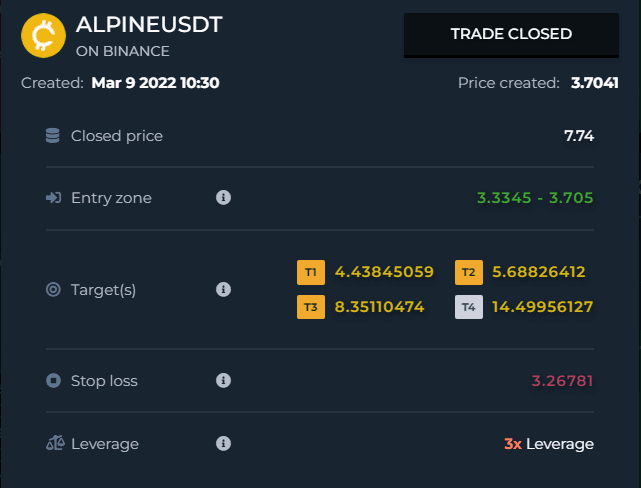

Let’s take our recent Alpine signal as an example:

I’ve drawn this up on the chart and you can see that our risk in this case was 6-7%.

You can use the Long/Short position tool in tradingview to quickly measure up what your play looks like.

In this case our reward at target 1 was around 30% and our stoploss as mentioned was around 7%.

So that’s a r:r of 7%:30% or roughly 1:4

At T2 1:10

T3 was 1:20

Pro tip – Use the position tool in tradingview to calculate your correct position size

You can jump into the settings of the position tool and adjust the account size and risk %. Then the tool will tell you how much you can place on this trade idea!

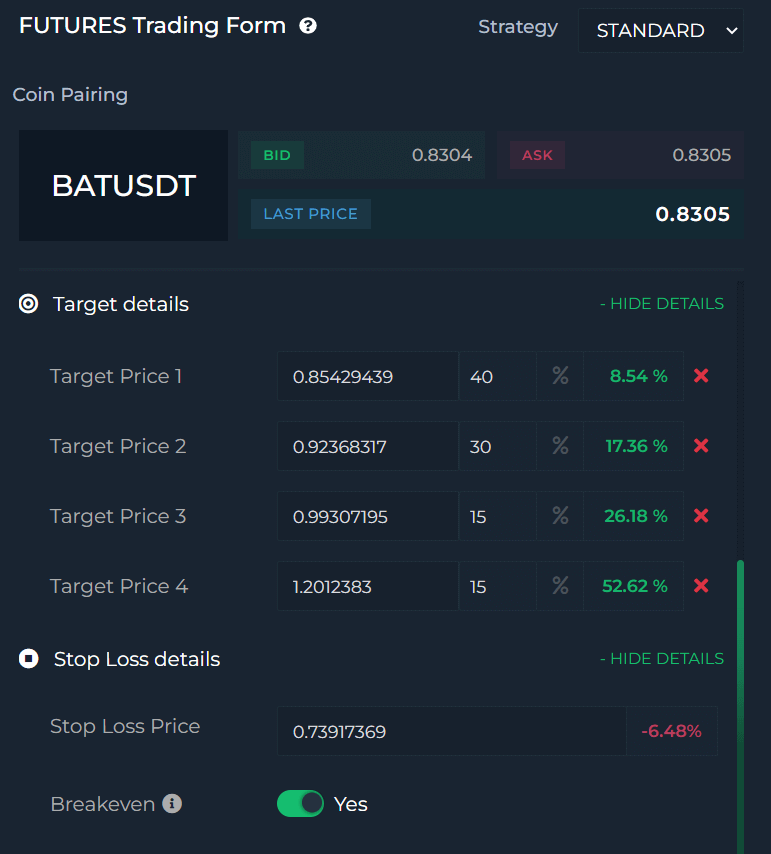

With the ProfitFarmers platform you can customize every trade plan before you fire it off. It’s not a bad idea to think about moving up that default suggested stop loss if you are planning to enter at the top of the buy zone.

Think about your overall risk: reward and don’t be afraid to experiment with taking multiple trades on a single signal until you find a format that works for you.

3. Final boss - Add your Win Rate into the mix

I can’t tell you what your win rate is. It’s going to depend on your skill, experience and how reliable the strategy is that you’re following.

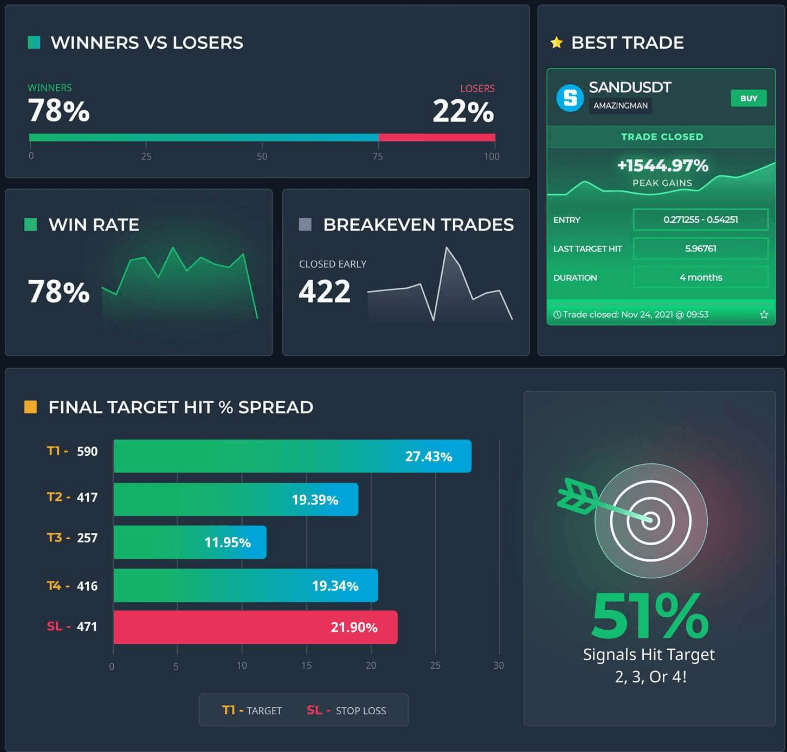

At Profitfarmers we regularly hit 70-80% win rates at target 1 for our completed trades. T2 is around 50%.

Here’s a snapshot of our results from 2021:

Traders will always have some plays that they close early as well for breakeven or a small win/loss. Factor these in depending on your overall entry strategy and how aggressive you are.

If you want to be very cautious, treat close early trades as a quarter loss or half a loss or whatever you feel is appropriate.

4. Combine your risk management with your risk:reward and then apply your expected win rate

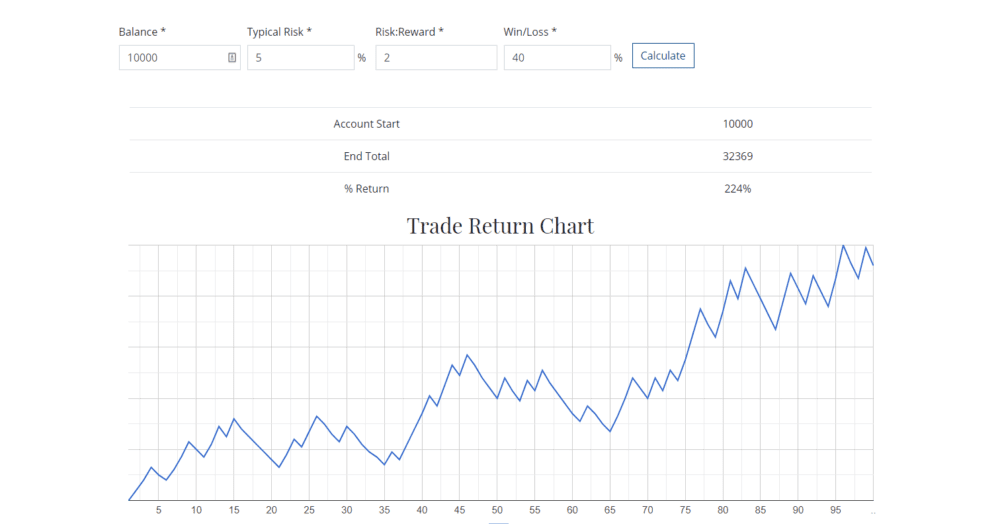

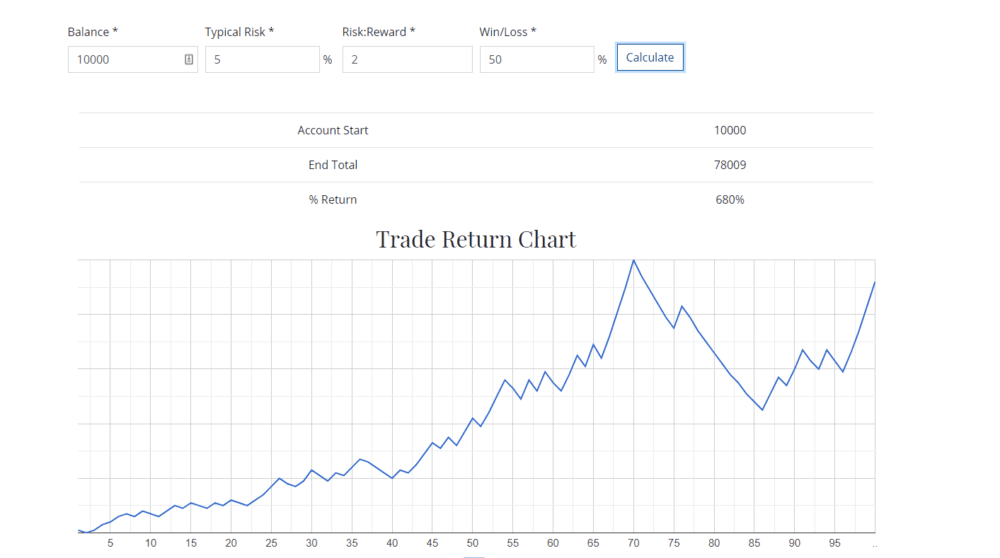

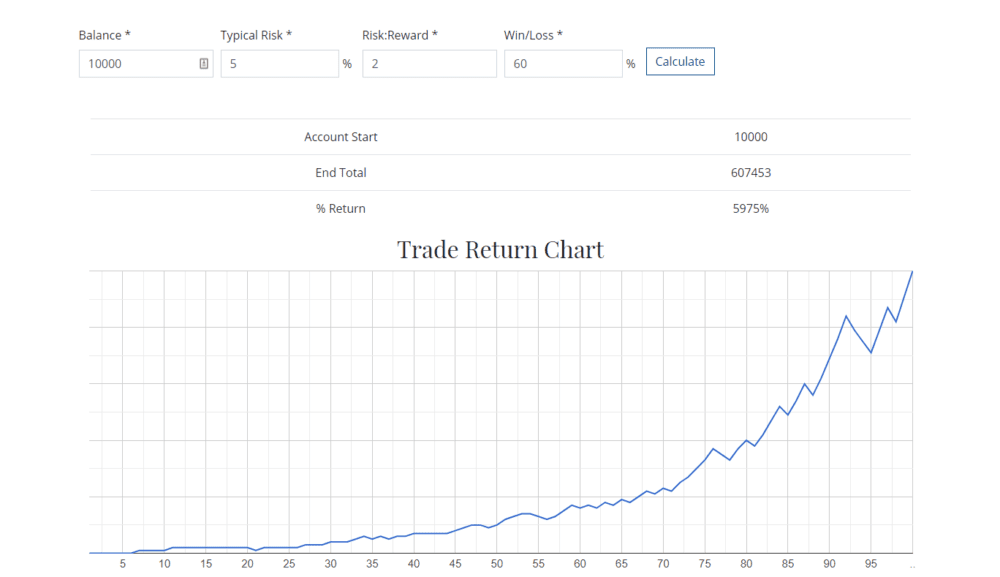

Shout out to Coghlan Capital for making this fun trade return calculator:

Plug in your expected trading metrics and this tool will spit out the results based on 100 random trade results.

Let’s take a few examples using our $10,000 balance, 5% risk per trade and R:R of just 1:2

40% win rate - 224% returns - Ending balance $32,369

50% win rate - 680% returns - Ending balance $78,009

60% win rate - 5975% returns - Ending balance $607,453

Just a note – If you lower your risk % you’ll smooth out the results that this type of tool spits out because it removes the element of bad luck crushing your account or good luck sending it into outer-space.

Conclusion

I hope you enjoyed that and found it really useful!

To wrap thing’s up…

Risk management stops you from blowing up your account and gives you the sustainability you need to be able to profit long term despite the market whipping you around and making you feel like a complete idiot half the time.

It also improves your health because you can stop freaking out about every market move, you know that a loss is just a part of the overall plan.

Being profitable is going to give you the freedom to have the lifestyle you want. It’s as simple as that. Some of us want fast cars and even faster women. Some of us want spare time and the chance to chase other passions or charitable endeavors.

Whatever it is, it’s all possible with the right method and strategy applied to your trading game.

Introducing, ProfitFarmers

ProfitFarmers combines AI trading signals with copytrading, market intelligence, and semi-automated trading features to make profitable trading as simple and stress-free as possible.

Our platform suggests, plans, and executes high-probability AI-backed trade plans semi-automatically, so you finally take your life back. Just select a signal and finalise your trade plan. ProfitFarmers does the rest. Trade like a pro without the stress, decades of experience, and sleepless nights.

We’ve developed the cure to:

- Not making enough money

- Losing sleep and price alarms upsetting your other half

- Staring at the charts all day even when nothing happens

- Riding the emotional rollercoaster

Bonus round - Trade Automations

But before we close off. I want to talk about trade automations.

Automations can push your sustainability, health and lifestyle to ALL TIME HIGHS.

Give me a minute to shamelessly plug the ProfitFarmers platform:

- Copy-Trading

- Laddering Mode

- Breakeven stop-loss

- And Trade Guardian

Are definitely our most loved features.

Copy-Trading saves tons of time, grants you access to professional trade ideas and removes all the human error.

Laddering mode makes getting into a trade really simple. If you can’t figure out the exact best entry, flip laddering mode on and off you go.

Breakeven Stop-Loss protects your hard earned profits and minimizes potential losses on price reversals all whilst you aren’t looking.

Trade Guardian can automatically exit trades early that seem to be deviating from the plan. Perfect for when you want to step away from the charts or get a decent night’s sleep.

At the end of the day it’s all about sticking to that plan and that’s what this platform is brilliant at.

(This helpdesk article is also published on our blog here: https://www.profitfarmers.com/blog/how-to-be-a-long-term-profitable-trader/)